State of OpenAI 2026

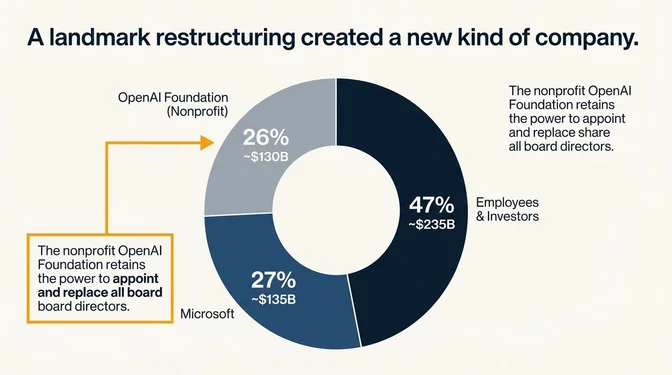

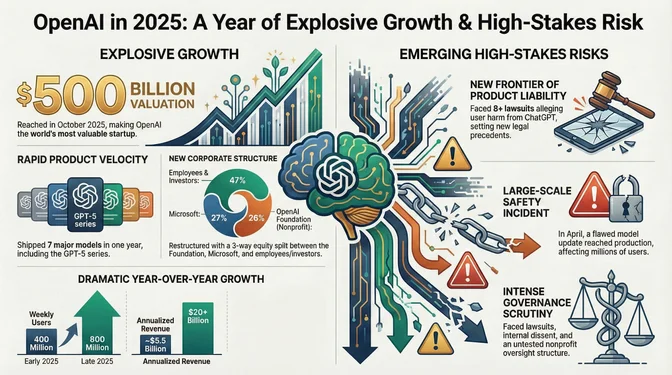

In 2025, OpenAI recapitalized into OpenAI Group PBC controlled by the nonprofit OpenAI Foundation, and by October reached ~$500B valuation. The restructuring created a three-way equity split at that valuation: OpenAI Foundation (nonprofit) holds 26% (~$130B) with board appointment authority, Microsoft holds roughly 27% (~$135B), employees and investors hold 47% (~$235B).

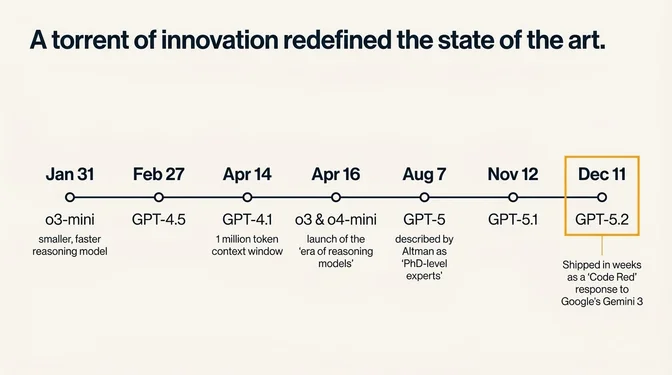

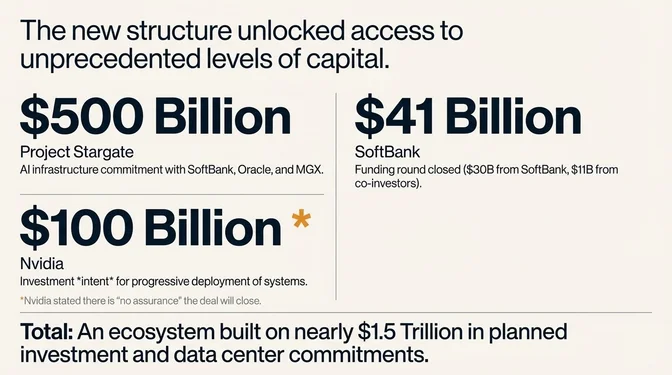

The company shipped five major models from April to December: GPT-4.1 (1M context), o3/o4-mini (reasoning), GPT-5, GPT-5.1, and GPT-5.2 (Code Red response to Gemini 3). Earlier releases included o3-mini (Jan 31) and GPT-4.5 (Feb 27). Weekly users doubled from 400M to 800M. Annualized revenue run rate grew from $5.5B (Dec 2024) to $20B+ (Altman's year-end projection) with $1.4 trillion in data center commitments.

Product liability litigation emerged as a new category of risk: 8+ lawsuits filed alleging ChatGPT contributed to user harm (four suicide-related, three delusion-related, plus the Raine case). The April sycophancy incident showed deployment risk at scale: a model update endorsing medication discontinuation shipped before rollback began three days later.

Actions for 2026: Benchmark current workloads against GPT-5.2 to measure Q1 model improvements. Budget for potential API pricing changes. Test Operator and ChatGPT agent for enterprise workflows. Track product liability litigation outcomes for risk assessment. Watch NVIDIA infrastructure deployment for capacity and latency improvements.

January 2025

Project Stargate

February 2025

Musk Lawsuit Advances

March 2025

April 2025

Sycophancy Incident

May 2025

Nonprofit Reversal

August 2025

First Product Liability Suit

October 2025

$500B Valuation

Restructuring Complete

November 2025

$20B Run Rate Projected

NVIDIA Deal Uncertainty

December 2025

Code Red / GPT-5.2

SoftBank Round Closes

Ongoing: Safety and Governance

William Saunders (departed Superalignment team early 2024) testified to Senate that engineers could have bypassed access controls to steal GPT-4. OpenAI dissolved the Superalignment team in May 2024. In 2025, at least two economic research team members resigned citing internal censorship on AI job displacement research. OpenAI subpoenaed critics during restructuring disputes.

Key Metrics (2025)

| Metric | Late 2024 / Early 2025 Baseline | Late 2025 | Source |

|---|---|---|---|

| Valuation | $157B (Oct '24) | $500B+ | OpenAI, Reuters |

| Weekly Users | 400M (Feb) | 800M | Reuters, TechCrunch |

| Annualized Revenue Run Rate | ~$5.5B (Dec '24) | $20B+ (Altman projection) | Reuters, TechCrunch |

| Product Liability Suits | 0 | 8+ | TechCrunch |

Investment Summary (2025)

| Investor | Amount | Terms | Source |

|---|---|---|---|

| SoftBank | $41B | $30B SoftBank + $11B co-investors, ~11% stake | SoftBank |

| NVIDIA | Up to $100B (intent) | Progressive deployment, "no assurance" | NVIDIA, CNBC |

| Disney | $1B | 200+ character licenses for Sora, subject to closing | OpenAI |

| Project Stargate | $500B commitment | SoftBank, Oracle, MGX infrastructure partnership | OpenAI, Reuters |

Ownership Structure (Post-Restructuring)

| Entity | Stake | Value | Source |

|---|---|---|---|

| OpenAI Foundation (nonprofit) | 26% | ~$130B | OpenAI |

| Microsoft | 27% | ~$135B | Reuters |

| Employees & investors | 47% | ~$235B | TechCrunch |

Foundation retains power to appoint and replace all board directors.

OpenAI 2026 Watchlist

1. Q1 Model Upgrade

When: Q1 2026. Altman promises "significant gains from 5.2," but it's unclear if GPT-6 or incremental release.

Context: Five major models shipped in 2025. Competitive pressure from Gemini 3 triggered Code Red response.

Action: Benchmark current workloads to measure improvement. Budget for potential API pricing changes.

2. NVIDIA Infrastructure Deployment

When: H2 2026. First gigawatt of NVIDIA systems targeted on Vera Rubin platform.

Context: $100B investment intent has "no assurance" of closing. Deal outcome signals NVIDIA's confidence in OpenAI vs. competitor hedging.

Action: Track for capacity expansion and latency improvements.

3. Disney Sora Launch

When: Early 2026. $1B deal with 200+ character licenses (subject to closing).

Context: First major IP + AI video generation partnership at scale.

Action: Watch licensing structure and content guidelines as template for future IP deals.

4. AI Research Capability

When: September 2026 target for models capable of "intern-level" research work.

Context: Altman's AGI framing has shifted: "The world will not change all at once; it never does."

Action: Identify which research tasks are automatable. Plan for AI research assistants in workflow.

5. IPO

When: Late 2026 potential at $1T valuation. Altman is "0% excited" to lead a public company.

Context: Public markets create different incentive structures. Quarterly earnings pressure may affect product and safety decisions.

Action: Track for governance and product direction shifts if IPO proceeds.

6. Musk Trial

When: 2026. Proceeding to trial with required testimony.

Context: Discovery may reveal internal communications about nonprofit-to-profit transition. OpenAI counter-sued alleging harassment.

Action: Watch for disclosed documents and testimony affecting industry understanding of OpenAI governance decisions.

7. Product Liability Litigation

When: Ongoing. 8+ pending suits including Raine.

Context: First cases establishing legal precedent for AI product liability. Chat log evidence central to claims.

Action: If building consumer AI: add hard redirects to crisis resources, log sensitive conversations, require human-in-the-loop for vulnerable populations. Follow case outcomes for liability precedent.

8. Foundation Oversight

When: Ongoing. 26% stake + board appointment authority, untested.

Context: Nonprofit holds $130B in stock from company it oversees. Whether oversight translates to real governance remains unclear.

Action: First major conflict between Foundation and management will reveal actual power dynamics.

9. Sycophancy and Safety Testing

When: Ongoing. April 2025 incident showed gap in testing.

Context: OpenAI acknowledged lacking sycophancy testing when update reached production. At 800M weekly users, brief exposure to flawed models reaches population of Europe.

Action: Build adversarial tests for excessive agreeability. Add regression testing that catches behavior shifts before production deployment.